Economic & Financial Market Commentary | Q3 2023

The first seven months of 2023 have produced some very pleasant, and somewhat unexpected, stock market returns. Let's take a deeper look at what's driving those returns, and how Market Street is responding to market changes as we move into Q3 of 2023.

S&P 500 — A Look Under the Hood

Year-to-date through the end of July, the S&P 500 was up over 20%. This has been achieved despite the aggressive interest rate hiking cycle that the Federal Reserve has undertaken to help cool inflation and the regional bank crisis that emerged in the latter parts of the first quarter this year.

However, when one “looks beneath the hood” of the S&P 500’s performance, you find that the gains have been concentrated among a very small number of large mega-cap technology firms, particularly those involved in AI (artificial intelligence) development.

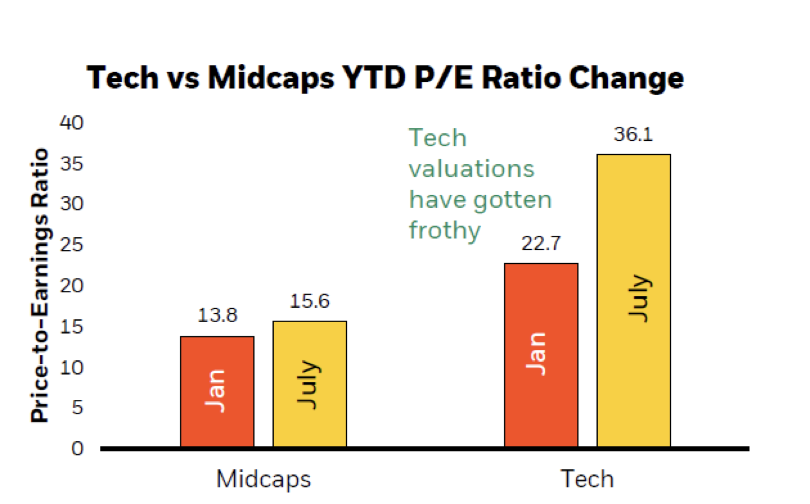

The rally in these stocks have pushed their forward-looking P/E (price/earnings) ratios to very high levels. While still believing in the long-term performance potential of this asset class, we feel now is the time to trim our sector overweight to technology.

While we are not convinced that the Federal Reserve has concluded their monetary tightening efforts, we are confident that they are nearing an end. This, along with the moderation of the regional banking crisis, forms the foundation of our belief that further advances in the stock market from current levels will likely broaden out to include other companies beyond the mega-cap technology stocks.

Market Street Tactical Adjustments

The preceding points form the basis for the tactical adjustments to our client portfolios that we began implementing in late July. These adjustments included:

Equity

- Taking some profits from our overweight technology positions.

- Broadening our large cap stock exposure.

- Adding a mid-cap fund to the majority of our model portfolios.

- Reducing our emerging market stock exposure in favor of more developed markets, with a slight bias towards value-oriented holdings.

Fixed Income

- Increased exposure to both short and long-term maturities (a barbell approach). This is a shift away from the larger concentration to intermediate-term bonds that we have held this year.

- Adding to the shorter maturities allows us to take advantage of higher yields in today’s inverted yield curve environment.

- This includes increasing our inflation protected and floating rate bond holdings. The longer maturities will benefit the most from an eventual decline in interest rates. The higher credit quality Treasury bonds will help protect the overall portfolio from most causes of future declines in stock prices.

Asset Class Rebalancing

As we implement some of these tactical adjustments to our client portfolios, we are also taking the opportunity to rebalance asset classes that have appreciated beyond our maximum target allocations and adding to positions that have fallen below our minimum target levels. This type of “Buy Low and Sell High” discipline adds to our clients’ portfolio performance over the long term.

Capital Gains

Some of the sales of funds that had significant price appreciation will result in capital gains in our clients’ taxable investment accounts. The capital loss harvesting that we did in 2022 that carried over into 2023 will help offset some of the tax impact of this year’s realized gains.

Managing our clients’ capital gains remains a very important part of our portfolio management process. This can be a very labor-intensive process, so many of you will continue to see some additional trades in your accounts over the next couple of weeks. We have largely completed the tactical trades within non-taxable and tax-deferred Schwab accounts.

Schwab Transactions

When completed, these quarterly trades do not usually result in large changes to your broad portfolio allocations. However, the trades can produce a large volume of transactions when spread among your multiple accounts and individual funds within asset classes do produce a large volume of transactions.

With the change in fixed income funds held in the majority of our client portfolios, this trade has more changes across most tax-deferred accounts than previous quarterly adjustments we have made.

If you are currently receiving mailed paper confirmations from Schwab and would like to have these switched to electronic notifications, please contact us and we will assist with that change.

Thank you for your continued trust in our firm. As always, please contact us with any questions or concerns.

WANT TO RECEIVE UPDATES TO YOUR INBOX?

Sign up for our newsletter